Sectors like real estate, insurance, and banks are affected by interest rates. When interest rates increase, borrowing money becomes more expensive, affecting the output and profitability of firms that rely on debt. So I wanted to look at the spread of returns on the high-yield (HYG) ETF and investment grade (LQD) ETF and see if it affects sector-specific ETFs and their returns in different periods.

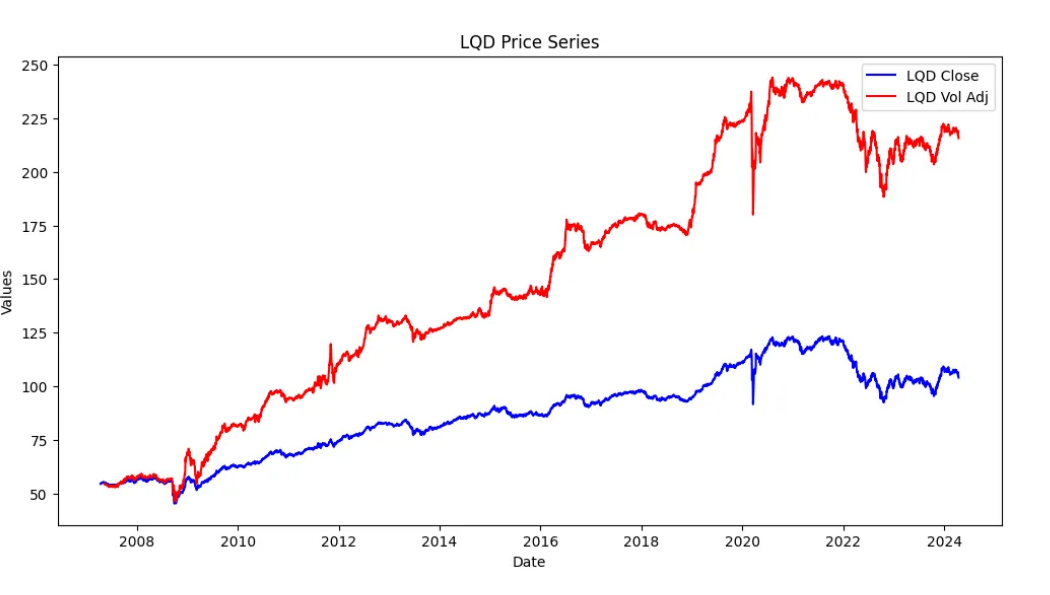

When looking at the returns between ETFs HYG and LQD we have to account for adjusting LQD returns to be consistent with HYG’s. The reason is that HYG holds riskier bonds, so their returns will be more volatile. To account for this we create a volatility ratio from HYG and LQD and multiply this ratio by LQD’s returns. This reduces the bias in our coefficients when we do our regression analysis. Below is the adjusted price series of LQD using a 20-day lookback period of volatility compared to the original.

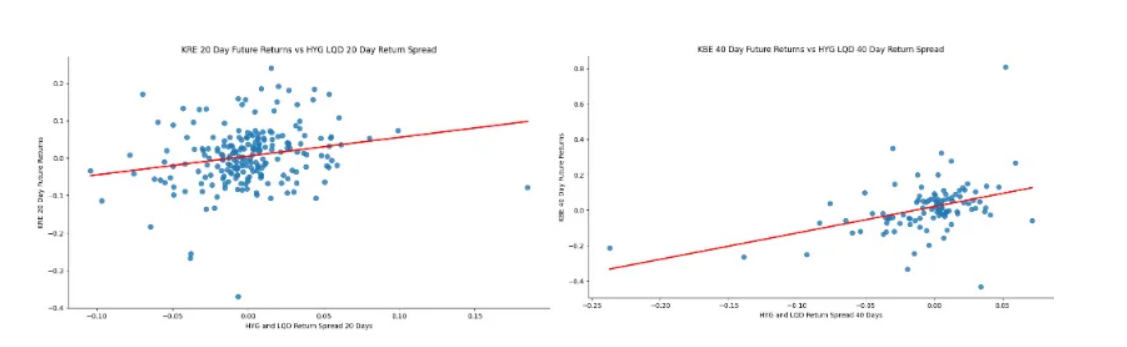

The strongest relationship between the return spread and future 40-day returns was in KBE which had an R2 of .161. Below are the regression results for KRE and KBE.

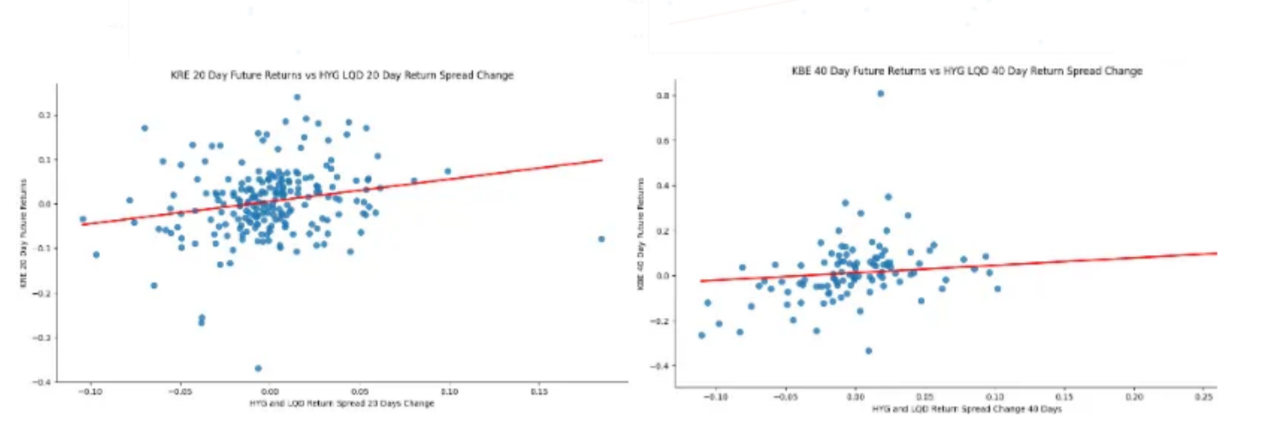

The results are similar with different lookback periods and the change in return spread had less explaining power.

Running the KS statistic I found that there is not a statistically significant difference in the shape for 20-day and 40-day future return distributions. This analysis covers the periods from 2007–2015 and 2016-present.

When running the Chow test to check for structural changes in these returns, we obtain statistically significant p-values for structural breaks in future returns using the 20-day change in the return spread. However, we did not find any significant results for the regular 20-day return spread. The 40-day lookback period mostly did not yield significant results.

Overall, the return spread had the greatest explanatory power for the banking sector’s future returns across both lookback periods. The return spread was a stronger independent variable than the change in return spread in explaining future returns. Additionally, we noticed that the distribution of returns for all these ETFs did not significantly change over time. Finally, the 20-day change in the return spread impacted the structure of 20-day future returns. When running the Chow test there was a structural break in change of the return spread and future returns.

Code can be found here

https://github.com/Gaiden-Spence/Fixed-Income-Return-Spread